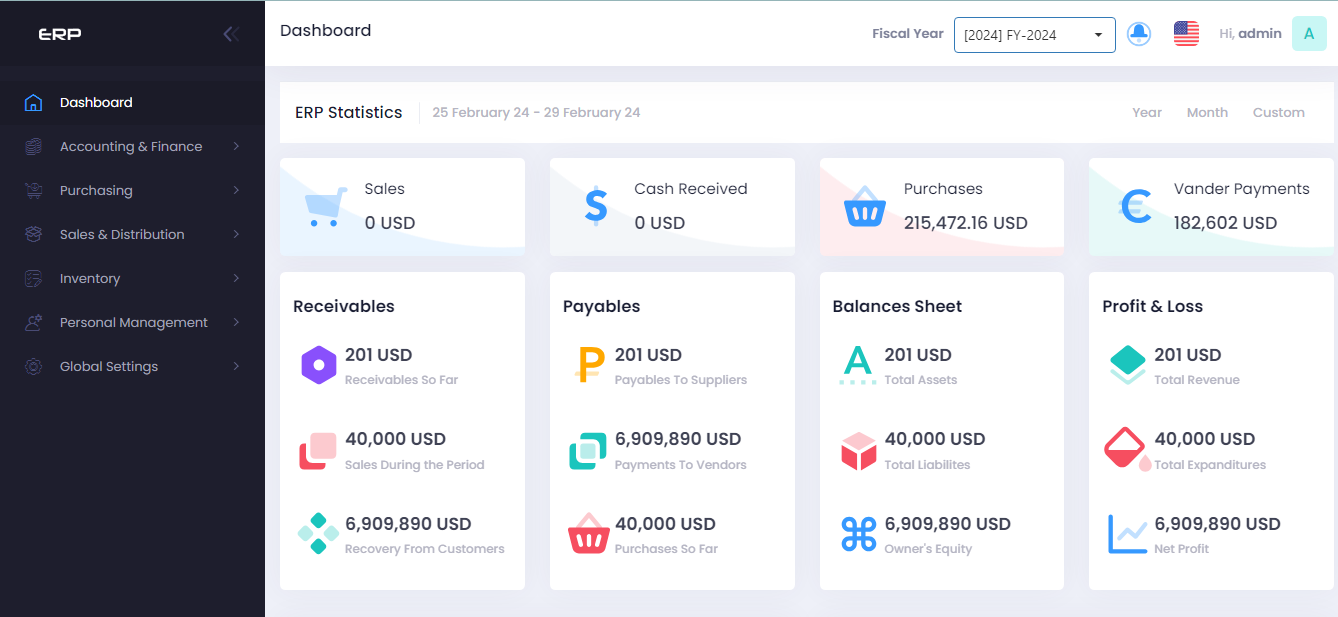

Power ERP

Power ERP is a real-time, integrated accounting system developed to meet the accounting requirements of enterprise-level organizations. The software takes advantage of the speed of client/server technology and the latest productivity enhancements of Microsoft SQL Server with superior scalability, up-time performance, and better data security

Regaining control over client accounting is possible with Power ERP.

Our Power ERP program is designed to empower businesses like yours, offering solutions to the challenges posed by traditional accounting software. With Power ERP, you gain access to advanced capabilities, integrating a comprehensive G/L system with professional-grade tools. By taking back control of your financial operations, you can foster stronger relationships with clients, drive business growth, and elevate your overall performance.

Extensive trial balance and financial statement capabilities

Setting itself apart from conventional cloud accounting software, our accounting solution for businesses boasts a diverse array of powerful features. Power ERP includes:

Bank feed-enabled write-up system Customizable trial balance with notes Editable entries Fully customizable financial statements Multiple reporting periods, including 13-month options Comprehensive analysis tools, including general ledger, trial balance, financials, and journals

Increase your post-event write-up's profitability by 30–40%

Power ERP is the only cloud accounting software that can match its speed and functionality for post-event write-ups. Power ERP has a bank feeds capability that downloads bank and credit card transactions in addition to heads-down data entry. By utilizing the bank feeds option, you may stretch out your write-up work over the year and cut down on data entry by 70%–80%, which will help you during tax season.

Accounting System G/L

Job costing, inventory, A/R, A/P, and banking are all included in our comprehensive G/L system. With just one mouse click, you may pay multiple vendors with this tool, which also removes the need to print and mail checks.

One way to provide CAS is by using the bookkeeping module internally, or by properly configuring the system and granting access to clients who wish to operate from their offices. View below.

Cooperate with clients that wish to split the cost of accounting services

You can collaborate with clients that wish to handle some accounting work in their offices by using Power ERP CAS. The ability to personalize the G/L module for each of those clients, granting them access to only the features they require and are capable of doing, is a key feature. This reduces customer errors and streamlines the system for your clients, saving your company a substantial amount of time. When your clients have completed entering transactions, your employees may log in and get to work doing the expert job.

Services for Paying Bills

You won’t need to purchase an external bill payment solution because Power ERP has a built-in bill payment feature. It has features that other solutions don’t have to help you manage and expedite your bill paying service. With a few mouse clicks, you can electronically pay any number of your clients’ inputted invoices.

Customers who are responsible for paying their own bills can use it to pay with our digital check feature, which eliminates the need to print checks.

Provide Easy and Profitable Outsourced Accounting Services

Power ERP CAS has emerged as a leading option for providing client accounting services because to its complete bookkeeping system, faster workflow for bill payment and receivable services, and exceptional professional system capabilities.

Your personnel may perform tasks now performed by your clients’ staff using Power ERP CAS, only more quickly, easily, and precisely, and all without ever leaving your office. You can provide extremely profitable client accounting services in this way thanks to Power ERP CAS.

Provide Virtual CFO and Advisory Services

With Power ERp CAS, you can provide advisory and virtual CFO services that include cash flow management, tracking key performance indicators, budget preparation, forecasting, company performance education, and more. Complete instruments consist of:

Alerts Quick View

Completely alterable financial statements

creating a budget dashboard

Analysis of performance

Ratios in finance

And a lot more